We were on the struggle bus throughout the month of February. I guess everyone always struggles the month after your New Year’s Resolution. But the true test is to see what you do after the failure. I will be honest I let my budget go in a lot of categories. Mainly because I didn’t plan. What worked really well in January was writing down the amount I spent in every category right away. That way I physically saw how much I spent and when I got close to my budget max, I was able to cut back. Going into March I will be more intentional, meal plan and map out all our planned expenses.

Groceries

I stuck with Walmart, Sam’s Club and Costco this month. We got a $200 gift certificate from our Citi Credit Card rewards so I used that towards groceries. I was not organized enough to separate the Kirkland clothes temptations and the food bought. So I know this number is high, but this number is not just groceries.

Budget: 800 Spent: 1600

Eating Out

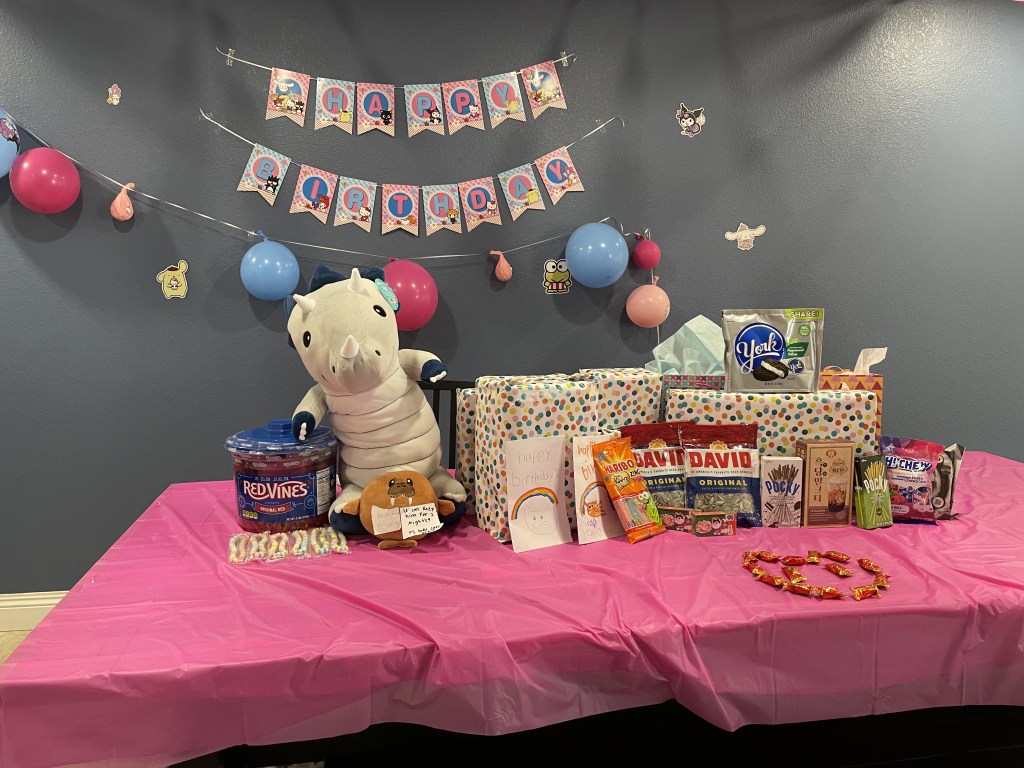

Oh boy we did a number on this category!! We did a big dinner for my daughter’s birthday, treating everyone to Mikunis. My husband and I have been doing date nights every Saturday which is adding up. But we only went to Dutch Bros one time!! Gotta look at the positives!

Budget: 300 Spent: 900

Gas

Gas was the only category we stayed in budget. Woohoo! I think we saved a bunch, because we stayed close to home.

Budget: 200 Spent: 200

Other

We had a ton of other items this month. My daughters birthday, hockey fees & car registrations. My kids were off track and I had mommy guilt of not doing a vacation so we went to Great Wolf Lodge. We got a great deal on Groupon but it was an extra $400 plus food that was not planned for. The kids needed shoes and instead of looking for a better deal I caved and paid full price. Most of these things can be budgeted for since they are expected.

Budget: 400 Spent: 550